There are several elements that make a finance chatbot not just functional but exceptional. In fact, if you are in the finance industry, there are a few things that chatbots not only can help the business with but also are essential for proper function in this new digital age. Let’s dive into the critical components that should form the blueprint of a finance chatbot designed for success.

Having a chatbot on a website is not enough for the finance industry. It must do and understand so much more. We’ve gathered the top things to keep in mind when deciding how advanced of a chatbot a finance business needs.

Table of Contents

- A Chatbot's Domain-Specific Knowledge

- Chatbots that Craft Intelligent Conversation

- Ensuring a User-Centric Chatbot Design

- Advanced Chatbot Features for Superior Performance

- Human Touch and Continuous Improvement

- Conclusion

A Chatbot’s Domain-Specific Knowledge

Finance, with its intricate terminology and complex processes, demands a chatbot with a deep understanding of the domain. A successful finance chatbot must be equipped with comprehensive knowledge of financial products, investment strategies, and regulatory frameworks. This knowledge enables the chatbot to engage in meaningful conversations, provide accurate information, and guide users effectively.

Data Security and Compliance

Security is paramount in the financial services sector, where the stakes are high, and trust is non-negotiable. A finance chatbot should adhere to stringent security standards to safeguard sensitive user information. This involves implementing robust encryption protocols, secure authentication mechanisms, and compliance with industry regulations such as GDPR or HIPAA, depending on the jurisdiction and the nature of financial services provided.

A Chatbot’s Real-time Integration with Financial Systems

A seamless connection with underlying financial systems is fundamental for a finance chatbot. Users expect real-time information on their accounts, transactions, and investment portfolios. The chatbot should be capable of integrating with banking and financial databases to fetch and present up-to-the-minute data, ensuring users have accurate and timely insights into their financial activities.

TruVISIBILITY’s Chat application was built for integrations. Any finance institution can build and deploy a chatbot while integrating it with numerous systems, such as an email messaging system, landing pages, and other webpages on the institution’s website, and more.

Chatbots that Craft Intelligent Conversations

Helping customers and even other institutions is vital for any chatbot, especially in the finance industry. When a customer has a problem with their account, money is involved. This is a serious matter for almost everyone, so a chatbot must know how to communicate and understand its users.

Wondering how you can design and deploy a finance institution chatbot in an easier way? Customize any of TruVISIBILITY’s chatbot templates to fit your brand and message. Check out these chatbot templates, some of which are specifically created with finance institutions in mind!

Natural Language Processing (NLP) Chatbots

Natural Language Processing is the backbone of effective communication between users and chatbots. A finance chatbot should be adept at understanding and interpreting user queries expressed in natural language. This goes beyond mere keyword matching, involving the ability to comprehend context, nuances, and variations in user inputs, contributing to more meaningful and contextually relevant responses.

Context Retention

Building on NLP, the ability to retain and understand context across multiple interactions is crucial. Users should feel like they are engaged in a continuous conversation rather than disjointed exchanges. A finance chatbot that can recall previous interactions, understand user history, and seamlessly carry forward the context enhances the user experience and facilitates more efficient problem-solving.

Personalization Engine

Personalization is a cornerstone of modern customer experiences. A finance chatbot equipped with a robust personalization engine can analyze user data, preferences, and behaviors to tailor its responses and recommendations. Whether it's suggesting personalized investment options, providing budgeting advice, or offering targeted promotions, personalization enhances user engagement and satisfaction.

Bots that have Transactional Capabilities

Beyond providing information, a finance chatbot should offer transactional capabilities. Users should be able to execute routine financial transactions seamlessly through the chat interface. This includes activities like fund transfers, bill payments, and balance inquiries. The chatbot should guide users through these processes securely and efficiently, mimicking the functionalities available through traditional banking channels.

Ensuring a User-Centric Chatbot Design

Designing a chatbot can be fun. It’s also important when it comes to user interface and accessibility for anyone visiting a financial website or social channel.

Intuitive User Interface (UI)

The user interface of a finance chatbot plays a pivotal role in shaping user interactions. An intuitive and user-friendly design ensures that users can navigate through the chatbot effortlessly. Clear menus, concise prompts, and an aesthetically pleasing interface contribute to a positive user experience, fostering engagement and satisfaction.

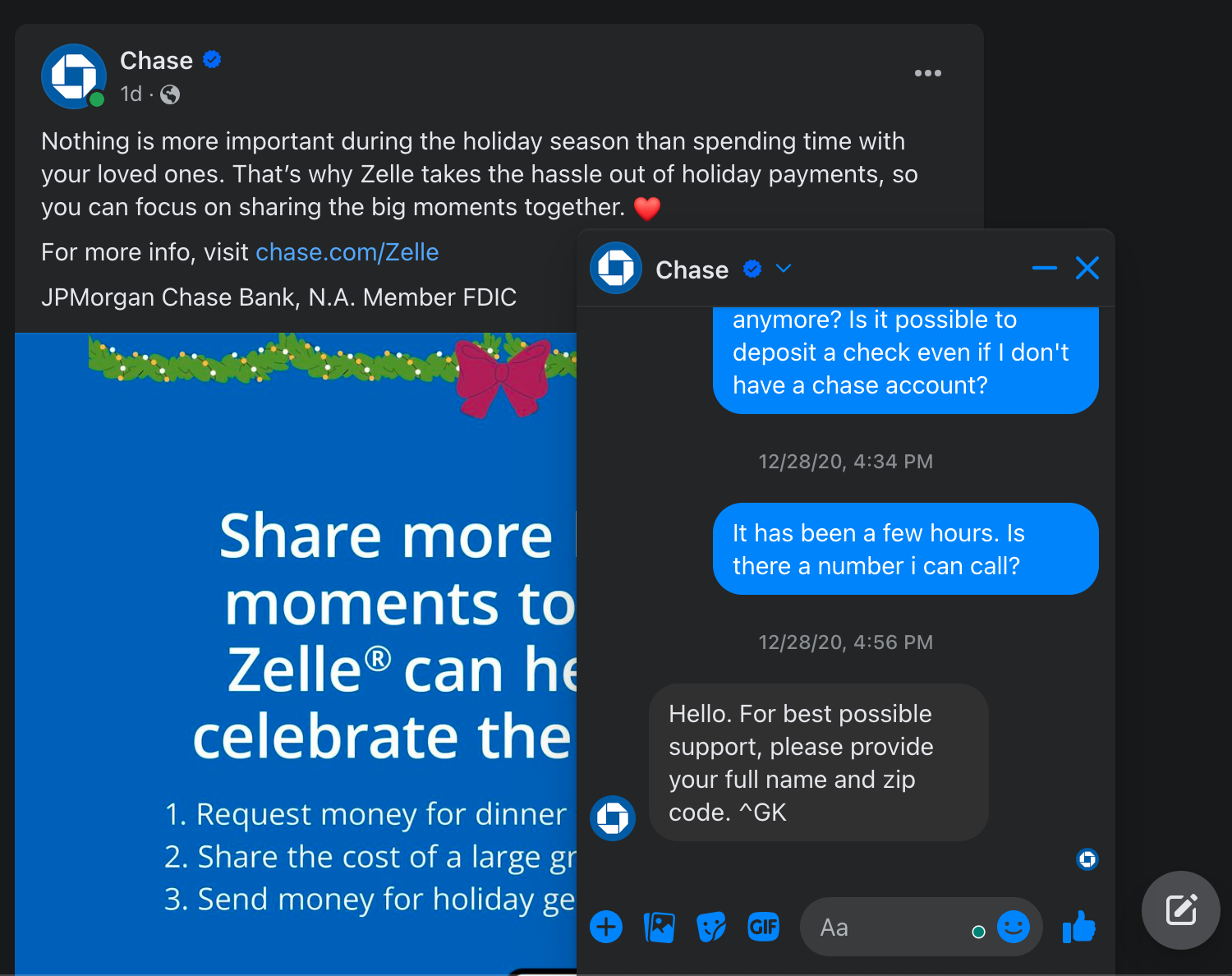

Multichannel Accessibility

Users engage with financial services across a myriad of platforms, including websites, mobile apps, and messaging platforms. A finance chatbot should be designed for multichannel accessibility, ensuring a consistent experience regardless of the platform. Whether users access the chatbot on a banking app or a messaging app, the interface and functionalities should remain cohesive.

Below is an example of a Chase chatbot on their Facebook channel, which isn't dissimilar to the chat capabilities on their website.

Device Compatibility

In an era where users access services through various devices, including smartphones, tablets, and desktops, a finance chatbot must be compatible with different screen sizes and resolutions. Responsive design ensures that the chatbot functions seamlessly across a spectrum of devices, optimizing user experience and accessibility.

Voice-Enabled Capabilities

The rise of voice-activated virtual assistants has underscored the significance of voice-enabled interactions. Integrating voice recognition capabilities into a finance chatbot enhances accessibility for users who prefer or require hands-free interactions. Voice commands can be utilized for tasks such as balance inquiries, fund transfers, or even complex financial queries.

Advanced Chatbot Features for Superior Performance

Do you think your particular finance business needs more features in a website chatbot or social media chatbot? Let’s go over a few extra options that are great for any business in the finance industry.

Machine Learning Algorithms

The integration of machine learning algorithms empowers a finance chatbot to evolve and improve over time. By analyzing user interactions and feedback, machine learning enables the chatbot to adapt to user preferences, refine its responses, and stay abreast of changing trends in the financial landscape.

Chatbots that Detect and Prevent Fraud

Given the prevalence of cyber threats and financial fraud, a finance chatbot should incorporate robust fraud detection and prevention mechanisms. Machine learning algorithms can analyze patterns of user behavior and transaction history to identify anomalies and flag potential fraudulent activities, adding an extra layer of security for users.

Integration with Financial Planning Tools

For users seeking comprehensive financial planning assistance, a chatbot that integrates with financial planning tools is invaluable. This could involve helping users set financial goals, create budget plans, or even simulate the impact of different investment strategies. Integration with financial planning tools positions the chatbot as a holistic resource for users seeking to optimize their financial well-being.

Human Touch and Continuous Improvement

Having an automated response for every human need is nice. However, some users need more. Whether it’s more account information or to submit a concern, there will always be a few users who want to eventually speak with a person directly regarding their finances. A chatbot can also make this happen for these customers.

Seamless Handover to Human Agents

While chatbots excel at handling routine queries, there are instances where human intervention becomes essential. A finance chatbot should facilitate a smooth transition to human agents when the complexity of a query exceeds its capabilities. Seamless handover ensures that users receive the personalized attention required for intricate financial matters.

User Feedback Mechanism

A feedback mechanism is instrumental in the iterative improvement of a finance chatbot. Users should have the opportunity to provide feedback on their interactions, allowing financial institutions to identify areas for enhancement, address user concerns, and align the chatbot with user expectations. Regularly collecting and analyzing feedback contributes to the continuous improvement of the chatbot's performance.

User Authentication and Identity Verification

Ensuring the security of user accounts and transactions requires robust user authentication and identity verification measures. A finance chatbot should employ secure methods, such as multi-factor authentication or biometric verification, to confirm the identity of users before providing access to sensitive information or executing transactions.

Conclusion

By incorporating the elements we just covered, financial institutions can develop chatbots that transcend functionality and become invaluable assets in their service offerings. From domain-specific knowledge to advanced features, user-centric design, and continuous improvement mechanisms, each element contributes to shaping a finance chatbot that not only meets user expectations but sets new standards for excellence in the ever-evolving realm of financial technology. As finance chatbots continue to evolve, their role in shaping the future of financial conversations is undeniable, offering users a seamless, intelligent, and personalized journey through the complexities of their financial landscapes.

Ready to build a chatbot for your financial institution? TruVISIBILITY allows businesses to incorporate all of the features mentioned in this article, and you can build and use your chatbot for free. Only pay for more conversations as your business grows. See TruVISIBILITY's chatbot templates, which you can customize any way you like to match your brand and message.

Want to receive more articles?

Sign-up for our weekly newsletter to receive info that will help your business grow